CoreLogic recently released a report entitled, United States Residential Foreclosure Crisis: 10 Years Later, in which they examined the years leading up to the crisis all the way through to present day.

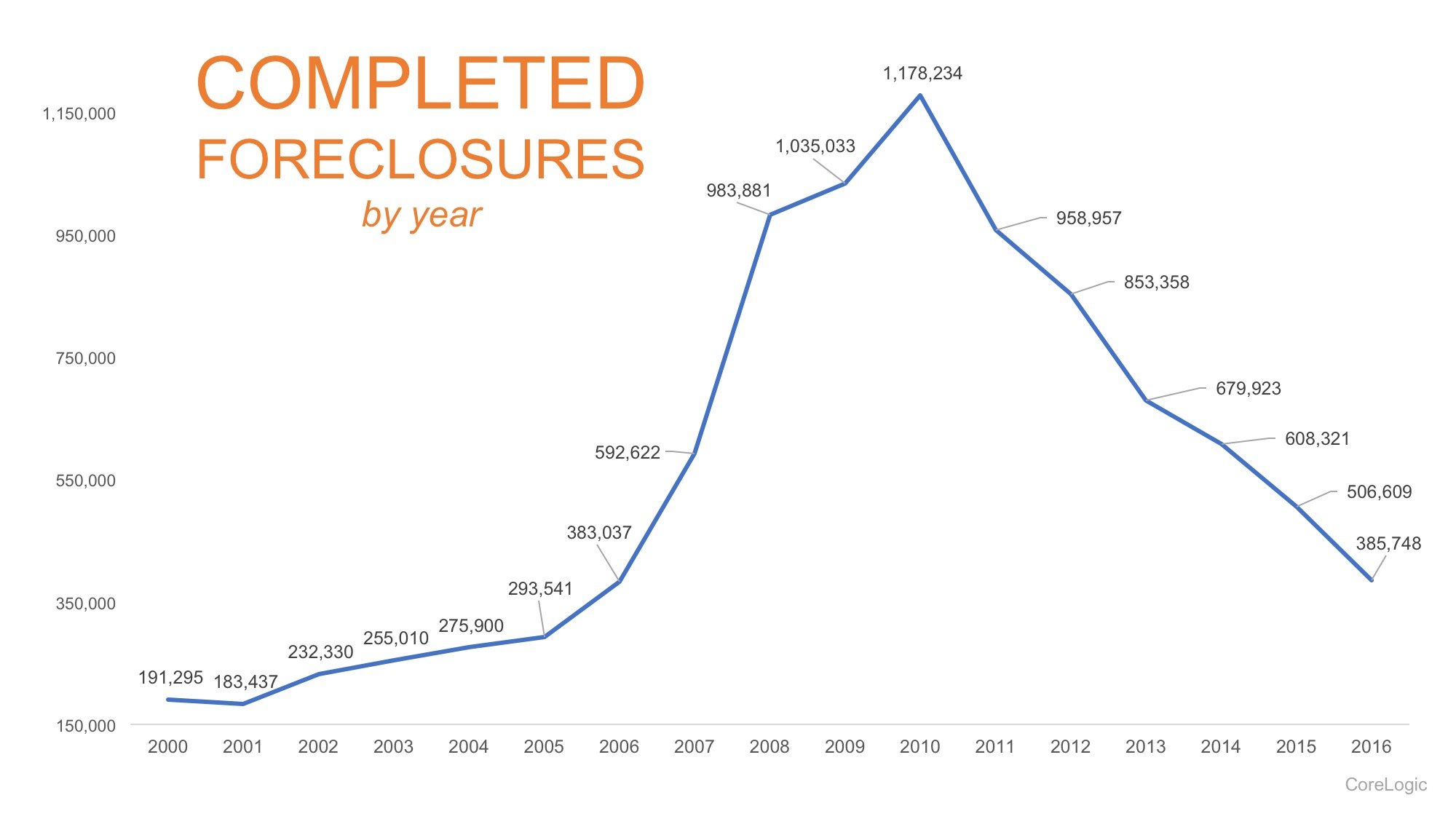

With a peak in 2010 when nearly 1.2 million homes were foreclosed on, over 7.7 million families lost their homes throughout the entire foreclosure crisis.

Dr. Frank Nothaft, Chief Economist for CoreLogic, had this to say,

“The country experienced a wild ride in the mortgage market between 2008 and 2012, with the foreclosure peak occurring in 2010. As we look back over 10 years of the foreclosure crisis, we cannot ignore the connection between jobs and homeownership. A healthy economy is driven by jobs coupled with consumer confidence that usually leads to homeownership.”

Since the peak, foreclosures have been steadily on the decline by nearly 100,000 per year all the way through the end of 2016, as seen in the chart below.

If this trend continues, the country will be back to 2005 levels by the end of 2017.

Underwater and Need to Move?

What should you do if you’re still underwater on your mortgage and you need to sell? Even in today’s market, millions of homeowners across the country owe more on their mortgages than what their homes would actually sell for. The Motley Fool published some great tips for what to do with their article Underwater on Your Mortgage? Do This Now. If none of these solutions work for you, check out my information and FAQs about selling your property with a short sale.

Bottom Line

As the economy continues to improve, and employment numbers increase, the number of completed foreclosures should continue to decrease. Give me a call to discuss the current real estate market. I’m happy to answer any questions – J.P. Cook – 602-320-4253.